CoinDesk Blames Traders for Binance’s Leveraged Token Scam

The “leveraged token” incident being referred to here is the one that occurred with Binance on May 17th-19th, 2021.

Binance leveraged tokens come are similar to binary options. They come in the form of “UP” or “DOWN” for tons of cryptocurrencies. For example, there’s a BTCUP and a BTCDOWN as well as an ETHUP and ETHDOWN.

The idea is that if you buy BTCUP, then you’ll make money when Bitcoin rises in price. Conversely, you’ll lose if it goes the opposite. The same idea goes for the BTCDOWN, ETHUP, ETHDOWN, etc.

Each of these positions is automatically leveraged. Binance claims that the leverage varies between 1x-4x, depending on the market conditions. However, on May 19th, as the markets tanked, many of the tokens on Binance’s exchange went sideways.

This, in itself, would not be an issue as trading is a risky endeavor and that risk is obviously the possibility of losing one’s money. However, one of those risks is not supposed to be the exchange locking traders out from their accounts so that they’re unable to manage their positions.

False Narrative About Trader Risk

Let’s go ahead and take a look at the CoinDesk article published on May 27th, 2021.

Below is a screenshot of the article’s subtitle.

The subtitle reads, “In a word, don’t put money in a risky investment that you don’t understand.”

Frankly, the article is an insult to all of those that were actually defrauded by Binance’s exchange during the tumultuous market activity that occurred around May 19th, 2021.

The article notes that there were traders that came out with losses that were invested in ‘ETHDOWN’, ‘BTCDOWN’, and other similar leveraged tokens that were designed to yield profit when the price of those assets declines.

However, rather than questioning the integrity of the platform itself, CoinDesk lends itself as a mouthpiece to Binance, arguing instead that the tokens were working functioning exactly how they were meant to.

Specifically, CoinDesk argues that the following happened:

- “Many Binance users saw an opportunity to capitalize on the massive sell-off and rushed to buy the inverse leveraged tokens. Demand spiked for BTCDOWN and ETHDOWN.”

- “But instead of going up as the market tanked, the tokens’ prices declined in some instances, some buyers said, adding the supply of the tokens appeared to increase dramatically. Some traders provided CoinDesk with screenshots they said supported their claims, and many argued on Twitter, Reddit and Discord that Binance should be held responsible.” (what’s remarkable about this is that CoinDesk acknowleges that they were provided direct evidence of user claims of fraud while failing to provide or discuss any of this alleged evidence, making the article completely one-sided in Binance’s favor).

- “What happened, according to the Binance representative, is that as the tokens’ value went up, a large number of them were redeemed in a short period of time. The capital allocated as backing for the tokens declined sharply.” (here we can see the ‘Binance representative’ is able to offer their stide of the story while those that were defrauded by Binance are forced to remains silent).

- “From there it gets quite complicated” (this is inexcusable; there were a ton of users that lost millions of dollars so if you’re going to cover the issue then cover it with the justice it deserves by actually explaining, in full, the ‘complexities’ behind this financial product), “but that imbalance kicked in the algorithm, leading to a series of steps including injecting futures positions into the capital base, which in turn increased the leverage in the structures to a level higher than the targeted range. That triggered additional steps that eventually caused the prices to erode.” (everything written here is unequivocally false and this is clearly Binance’s front story, fed to CoinDesk [or perhaps hatched by CoinDesk directly] to ensure that more unsuspecting users make the mistake of throwing their money down the black hole of Binance exchange in blissful ignorance])

- “From there it gets quite complicated, but that imbalance kicked in the algorithm, leading to a series of steps including injecting futures positions into the capital base, which in turn increased the leverage in the structures to a level higher than the targeted range. That triggered additional steps that eventually caused the prices to erode.”

- “After last week’s incident, some posters on social media accused Binance of increasing the supply of some of its leveraged tokens out of thin air. Such claims are unfounded, according to the exchange.” (again, only BInance’s take on the events is given a voice – fraudulently so)

- “The Binance leveraged tokens also differ from competitors’ in that they rely on a target range of variable leverage rather than a constant leverage ratio; for the BTCDOWN token, it ranges from 1.25 times to four times.” (its good that CoinDesk at least mentions this fact because it is something tthat we can use later to show that Binance was clearly defrauding all of the users on their platform)

- “Binance provided the example below of how the rebalancing algorithm works. Tl;dr: There’s a lot more to it than betting on price-go-up or price-go-down in already-risky spot cryptocurrency markets.” (at this point, the bias in this article should be clear; CoinDesk is assisting Binance in covering up blatant market fraud with their leveraged tokens by making it seems as though they’re some sort of super complex financial derivative that only a few geniuses in the world can wrap their minds around, when this couldn’t be any further from reality).

The article concludes with a lengthy example (clearly given by Binance), that shows how the leverage for a given position can fluctuate over time.

As stated on the Binance website, CoinDesk reiterates the claim that these products are only meant to fluctuate between 1-4x leverage (in either direction) at any given point in time.

The inference here is that traders simply didn’t read the fine print and that that’s why they suffered the losses that they did on May 19th. Furthermore, the complexities of these leveraged tokens apparently make them so difficult to understand that even in the aftermath of the carnage that occurred that weekend (May 17th-19th), traders are still unable to grasp how and/or why they lost out in these positions.

Sadly, this narrative is wholly untrue. It also serves as an example of irresponsible journalism that crosses into the zone of unethical. So, since CoinDesk is struggling to find a single honest writer this year, Librehash will once again come in & save the day by correcting the disinformation being spread actively by CoinDesk (among other outlets).

Hunting Down User Feedback

In order to ascertain what really happened on Binance’s exchange on May 19th, we need to reference some posts in live time to get a better understanding of the situation.

Below is a great place for us to start (tweet dated May 20th, 2021).

https://twitter.com/chandrayuda/status/1395343536388677636/photo/1

In case folks are unable to see from the embedded tweet, here is a copy of the picture that this user put up from Binance’s exchange in the 24-hour span of time since the markets had dumped viciously on May 19th, 2021.

Making a Couple of Observations

- We can see that traders would have lost no matter what position they chose (be it ‘UP’ or ‘DOWN’).

- Some of the tokens, like ‘ETHDOWN’ depreciated by a preposterous amount during that 24-hour span (-90.32%). When considering the overall price action of Ethereum during this span of time, there’s no logical reason for why it would’ve dropped by >90%.

Taking a Quick Look at Ethereum

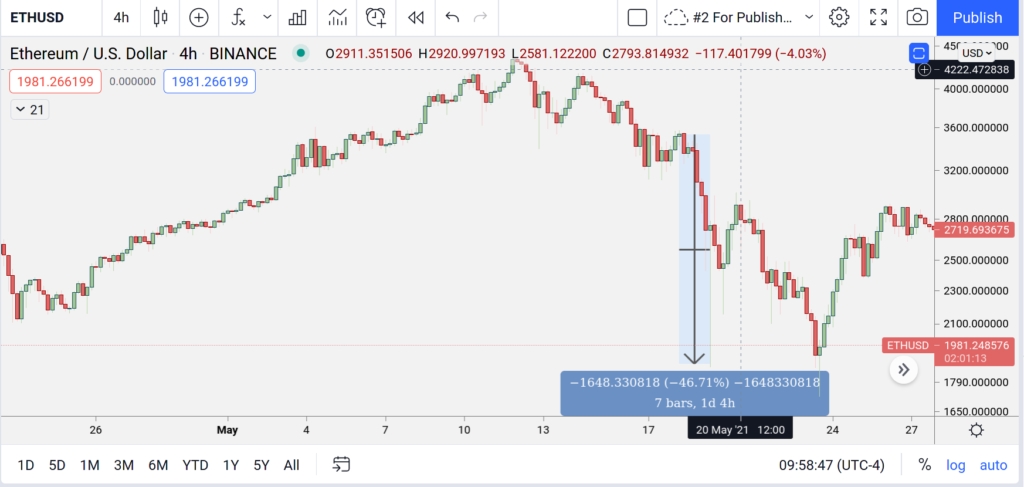

Even though Ethereum is far from the only asset that behaved in a counter-intuitive manner on Binance’s exchange, we’re still going to go ahead and take a look at the overall price action for Ethereum during the relevant time span (starting at approx. May 18th-20th).

As we can see, the price of Ethereum declined nearly 50% in only a day and a half.

When taking that price action into consideration alongside CoinDesk’s insistence that the floating leverage for these assets remains within the 1-4x bound, its clear that something here isn’t adding up.

Going back to the tweet from one of Binance’s users that we found earlier, we can see that the ‘ETHDOWN’ token was crushed even harder than ‘ETHUP’ (losing -90% of its value).

There’s truly no rhyme or reason for why this asset would have lost this much of its value if we’re to believe any of the facts relayed in the CoinDesk article are actually true (which they demonstrably aren’t).

Thus, we can chuck this up to another instance of CoinDesk lying to its readers on behalf of an international, criminal money laundering empire (that’s also wanted by damn near every jurisdiction on planet earth).